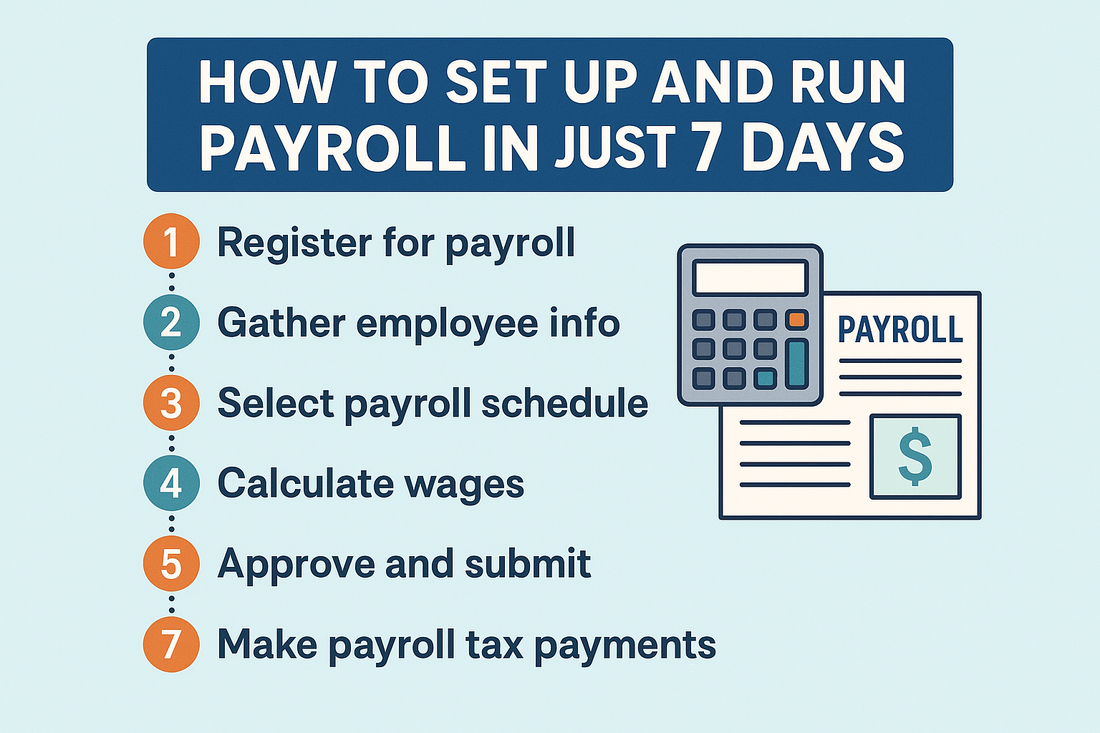

How to Set Up and Run Payroll in Just 7 Days

Setting up payroll sounds like a huge task, especially if you’re doing it for the first time. Whether you're launching a startup or shifting from manual processes to automation, it can feel overwhelming. But here's the good news: with the right plan in place, you can go from zero to fully functional payroll in just one week. Seriously.

You do not require a large HR team or several months of planning. It just takes focus, the right tools, and a day-by-day approach. This blog provides you with an effective, easy step-by-step payroll startup guide to enable you to set up and prepare your payroll easily, even when it is new to you.

Day 1: Get Your Business Payroll-Ready

Before you start calculating salaries, you need to get a few things in order. First, make sure your business is legally registered. You’ll need a PAN, GST (if applicable), and a bank account in your company’s name.

Next, apply for relevant payroll IDs like EPFO (for Provident Fund), ESIC (for employee insurance), and your Professional Tax Registration, depending on your state. These registrations are essential if you’re hiring full-time staff.

Checklist for Day 1:

- Company registration (LLP/Pvt Ltd/Proprietorship)

- Company PAN

- Bank account in business name

- PF, ESIC, and PT registration numbers

This might seem a lot, but most of it can be done online or with your accountant’s help.

Day 2: Choose a Payroll System That Works for You

On day two, it’s time to pick how you’ll actually manage your payroll. You have two options:

- Do it manually with spreadsheets (not recommended for more than 2-3 employees).

- Use payroll software or hire a service provider.

If you are a small business or startup, then a solution like ClearSlip can make it easy to get payroll up and running. It automates the process of calculating salaries, makes payslips, and manages tax deductions without having full-time HR employees.

Make sure the tool you choose is compliant with Indian laws and offers features like TDS, PF, and leave management if needed.

What to look for in payroll software:

- Simple onboarding process

- Automatic calculation of salary, taxes, and deductions

- Payslip generation

- Compliance support (PF, ESI, PT, TDS)

- Option to send payslips via email or WhatsApp

Day 3: Collect and Organize Employee Data

Now that your system is in place, it’s time to gather employee details. This is one of the most important steps in payroll implementation. Make sure all documents are accurate and verified before uploading them into your system.

You’ll need:

- Full name and address

- Date of joining

- Bank details

- PAN and Aadhaar copies

- Salary structure (CTC breakup)

- Email and mobile number

Most payroll software programs have an employee master area where you can input or load this information.

Organizing your data correctly now saves you from future salary errors or tax filing issues.

Day 4: Finalize Salary Structures and Deductions

Every employee should have a defined salary structure. Even if you only have 3-4 employees, you need to break down the salary into components like basic pay, HRA, special allowance, and deductions like PF or ESI.

A common structure for a ₹30,000 monthly salary might look like this:

| Component | Amount (₹) |

|---|---|

| Basic Salary | 15,000 |

| HRA | 6,000 |

| Special Allowance | 7,500 |

| PF (Employer) | 1,500 |

Ensure that you consult your accountant or use the templates that are built into your payroll software to calculate these correctly. You should also calculate the payment cycle: monthly, bi-weekly, or weekly. The majority of the companies remain on a monthly basis.

Day 5: Set Up Statutory Compliance

This is where many businesses hesitate, but it’s not that hard once you know what’s needed. Payroll in India involves mandatory deductions and filings, depending on the number of employees and location.

Key elements include:

- Provident Fund (PF): If you have more than 20 employees

- ESIC: If salaries are less than ₹21,000/month

- Professional Tax (PT): Mandatory in some states

- TDS (Tax Deducted at Source): For employees under income tax bracket

If you're using ClearSlip or any professional payroll tool, these calculations are done for you automatically. You only need to ensure the correct employee details are in place.

Also, make sure to prepare your payment files and challans for PF, ESI, and TDS. These need to be filed monthly.

Day 6: Run a Dummy Payroll

Before you go live, always run a mock or test payroll. This means simulating salary payments without actually crediting any bank accounts. The purpose is to check:

- Are salary calculations correct?

- Are deductions accurate?

- Are payslips being generated properly?

- Is the software calculating TDS as expected?

If something looks off, this is your chance to fix it. Most good payroll systems let you preview everything before finalizing. Don’t skip this step—it saves you a lot of trouble later.

Day 7: Run Payroll and Distribute Payslips

You’re now ready to go live. Review everything one last time, finalize salaries, and process payments via your company’s bank. If you’ve integrated payroll with your banking system, this is a smooth process.

Once salaries are paid, use your payroll tool to generate and send payslips. With ClearSlip, for example, you can even deliver payslips directly to employees over WhatsApp, no email or login needed.

Also, ensure your compliance reports (PF, ESI, PT) are generated and scheduled for filing.

That’s it—you’ve now set up payroll and processed your first cycle in just seven days.

Bonus Tips for Smooth Payroll Management

- Keep a master payroll calendar with deadlines for filings and payments.

- Review new tax rules each financial year.

- Offer employees self-service access to view or download their payslips.

- Regularly back up payroll data and maintain confidentiality.

- If you're scaling fast, consider automating leave and attendance tracking too.

Why Quick Payroll Setup Matters for Startups

For startups, time is everything. Every hour saved on operations is an hour spent on growth. Setting up payroll quickly and correctly means employees are paid on time, legal headaches are avoided, and founders get to focus on what really matters—building the business.

With the right approach and tools, payroll doesn’t need to be a headache. You don’t have to wait for weeks or depend on multiple consultants. You just need clarity, a good system, and a plan. And now, you have one.

FAQ

1. Can a company really set up payroll in 7 days?

Yes, it’s absolutely doable. If your documents are in order and you use a good payroll tool, you can get everything from setup to first salary payout done within a week, even without a big HR team.

2. What information is required to start payroll quickly?

You’ll need basic company registrations (like PAN, bank account, PF/ESI IDs), and employee details such as PAN, bank info, and salary structure. Having these ready speeds up onboarding into any payroll system.

3. Which payroll software helps speed up payroll setup?

With tools such as ClearSlip, payroll is quick and easy to establish. They are easy to onboard, with calculation automation, and also compliance, which makes it a good fit with a new business or a company that has a strict deadline.

4. Do you need an HRMS to run payroll?

Not necessarily. There is certainly no need to have a full HRMS to do payroll, particularly when you are only beginning. Nevertheless, a simple payroll system or software will aid in automating the processes and eliminate manual errors.

5. What are the common mistakes when starting payroll fast?

Running through without verifying the data of the employees, not following the compliance steps such as PF or TDS registration, or not doing a test payroll are some of the ways in which errors may come up. Never go live without checking twice.

6. How does WhatsApp payslip delivery work?

With solutions like ClearSlip, payslips are securely sent to employees over WhatsApp. It’s instant, convenient, and doesn’t require employees to log into any portal to view their salary details.

7. Can small teams manage payroll on their own?

Yes, even a 2-3 person team can manage payroll if they use the right software. You don’t need a full HR department—just a bit of setup, good data, and the right tool to automate the rest.

8. Is outsourcing payroll faster than setting it up in-house?

It can be, especially if you're short on time or don’t have experience with tax filings. Outsourcing lets experts handle everything, while you stay focused on your business operations.